|

|

|

|

#13411 | |

|

Mod Team

Join Date: Sep 2011

Location: Valley of the hot as ****

|

Quote:

Thanks for your information.  |

|

|

Posts: 45,664

|

|

|

|

#13412 |

|

Why so serious?

Join Date: Dec 2016

Location: Chicago

|

|

|

Posts: 12,392

|

|

|

|

#13413 | |

|

Why so serious?

Join Date: Dec 2016

Location: Chicago

|

Quote:

Huge institutions invest with money managers all the time - itís their easiest avenue to deploy capital into the markets - and they definitely arenít spreading out a $5bn allotment amongst a thousand different managers. |

|

|

Posts: 12,392

|

|

|

|

#13414 |

|

Veteran

Join Date: Feb 2012

Location: DE

|

|

|

Posts: 3,812

|

|

|

|

#13415 |

|

Why so serious?

Join Date: Dec 2016

Location: Chicago

|

It's a bailout to provide insurance for a fee? I guess.

Your job that I presume you have right now wouldn't exist if the government hadn't taken those steps. Insured depositors in those same banks wouldn't have been made whole if the government hadn't taken those steps. |

|

Posts: 12,392

|

|

|

|

#13416 |

|

Beer Sherpa

Join Date: Oct 2001

Location: shackled in a cellar

|

Twisted,

I assume you are talking about funds like VMRXX, VMFXX, or VUSXX. Is that right or is there something else that you'd recommend parking extra cash in with Vanguard? And if it is funds like that trio, is there one that you recommend over the other? Thanks. |

|

Posts: 1,727

|

|

|

|

#13417 | |

|

Why so serious?

Join Date: Dec 2016

Location: Chicago

|

Quote:

And yes, those funds. By virtue of my job I tend to keep more in cash than what anyone would recommend, and 4.5-5% seems delightful relative to some riskier things that I get pitched with IRRs maybe 2x that. |

|

|

Posts: 12,392

|

|

|

|

#13418 |

|

Why so serious?

Join Date: Dec 2016

Location: Chicago

|

In any case, government stepped in to make uninsured depositors in SVB whole. If the government loses money, they essentially tax the banks.

Fed comes out strong providing liquidity to other banks who may experience outflows. Outflows will happen but this is still best case scenario for weaker banks. I'm sure this story will still percolate and simmer but the tail risks meaningfully reduced in my mind. |

|

Posts: 12,392

|

|

|

|

#13419 | |

|

Beer Sherpa

Join Date: Oct 2001

Location: shackled in a cellar

|

Quote:

|

|

|

Posts: 1,727

|

|

|

|

#13420 |

|

NFL's #1 Ermines Fan

Join Date: Jul 2001

Location: My house

|

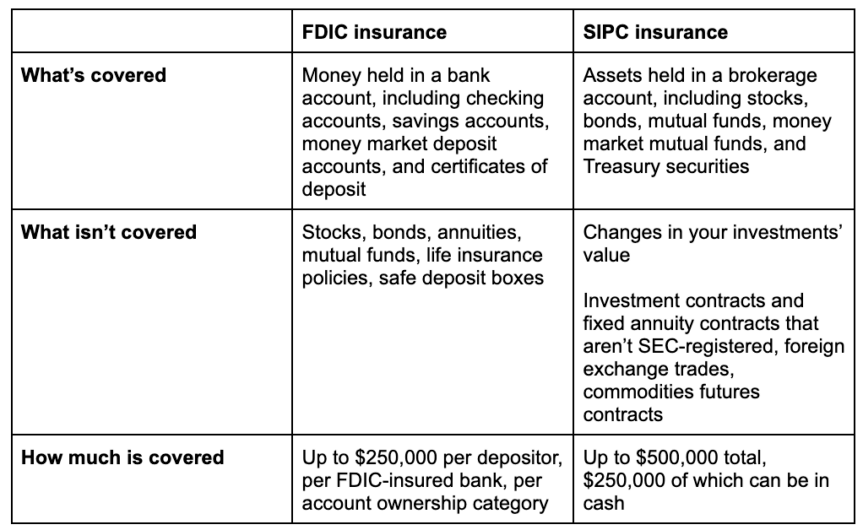

I've got a big clump of money in one private online broker, which makes me a little nervous. It just kind of happened for various reasons. I keep pondering whether I should move some to another broker just to be sure no catastrophe strikes. Should I? It sounds like I shouldn't be worried that one of the big mainstream brokers will suddenly go belly up.

I would have never used the words "CDs" and "bold" in the same sentence before, but I'm making a bold move into CDs. I've been buying them on 1-5 year time frames with the plan that inflation will go down and I'll end up with CDs that are beating inflation. I think it's a reasonable bet, and my goal is just to match or beat inflation at this point. I think rates are still going up, so I'm buying into them somewhat slowly right now. I'm not putting anywhere near $250k into any one CD, but they're mostly going through the one brokerage, so I hope that's not a risk. |

|

Posts: 141,673

|

|

|

|

#13421 | |

|

Why so serious?

Join Date: Dec 2016

Location: Chicago

|

Quote:

|

|

|

Posts: 12,392

|

|

|

|

#13422 | |

|

NFL's #1 Ermines Fan

Join Date: Jul 2001

Location: My house

|

Quote:

I keep looking at Treasuries, but I don't know enough about them. The second photo is what I see when I do a search. I used 2-year Treasuries to be consistent across both pictures. I don't understand what the variables are. I tried looking them up, and the key to me seemed like the "Yield to Worst", which was explained as the worst-case scenario yield. But that implies that there are situations where I can do better than that. And the Coupon seems important because I read that that's the nominal rate, but they're all over the board and I don't know what that means. Why would I be expecting a 4.679+ return off of a bond that has a 1.125 percent nominal rate? I'm sure I'm misunderstanding something. What I see is that the CD rates are higher and I understand them, so that's what I've been buying. Can you explain why Treasuries should be considered when looking at the two pictures below? Thanks in advance. |

|

|

Posts: 141,673

|

|

|

|

#13423 |

|

NFL's #1 Ermines Fan

Join Date: Jul 2001

Location: My house

|

Here's something I find kind of humorous. I saw that 5-year CDs were being offered up to 5.4 percent, so I looked at them. The top offerer is the "Bank of Bird-in-Hand".

Does that sound scammy or what? So I looked up this bank, and it turns out that it's a small bank that's located in the town of Bird-In-Hand, Pennsylvania. It caters mostly to Amish people, and in fact their drive-through window is designed to accommodate horses and buggies. I might have to put a little money into this Amish bank's 5.4 percent rate. |

|

Posts: 141,673

|

|

|

|

#13424 |

|

fides quaerens intellectum

Join Date: Oct 2003

Location: United States

|

I would go with that bank. After all, it's better to have an account with Bank of Bird-in-Hand than two at Bank of Bird-in-Bush.

|

|

Posts: 15,986

|

|

|

|

#13425 | |

|

NFL's #1 Ermines Fan

Join Date: Jul 2001

Location: My house

|

Quote:

I wonder if the Bank of Bird-In-Hand will give me my monthly dividend in $20 gold pieces. Because that would be kind of cool. |

|

|

Posts: 141,673

|

|

|

|

|